Digitalization of pay stubs

Digitalize your payslips to save time with the tools available on the PeopleSpheres Store.

Opt for digital pay stubs.

Your connected tools

Docaposte (Digital Archiving and Storage)

eDoc (Electronic Payslips)

Lucca (Pagga Payslips)

Discover all the tools connected to PeopleSpheres

See all the toolsOpt for digital pay stubs

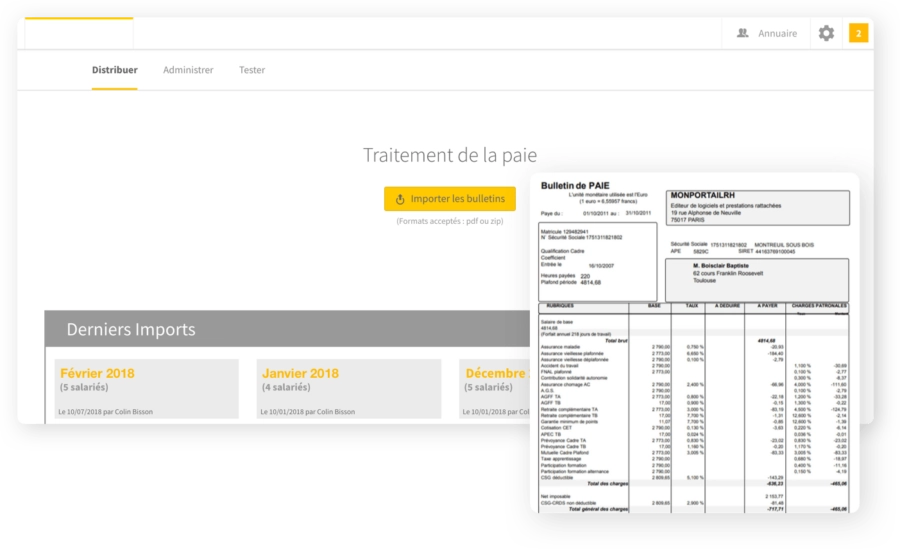

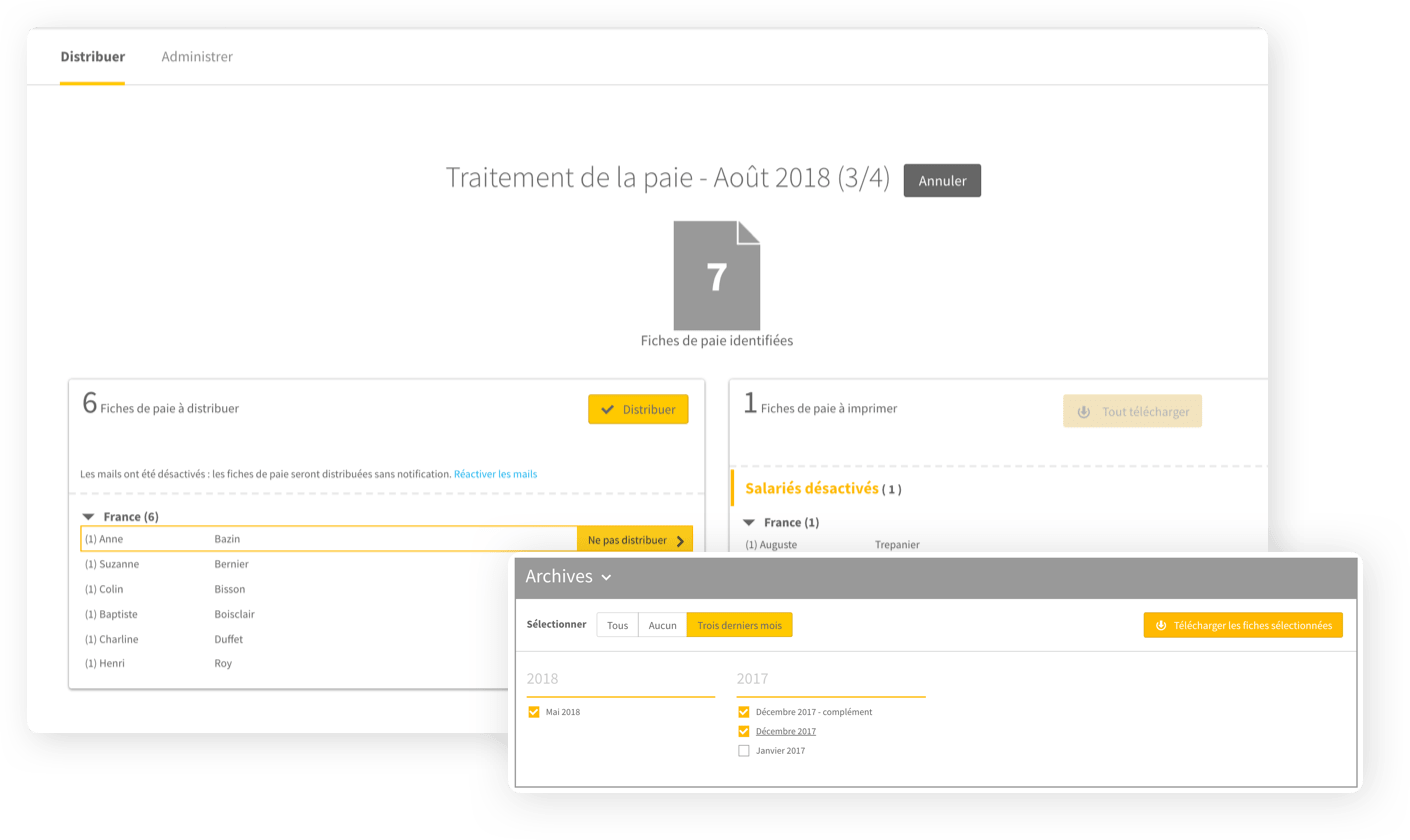

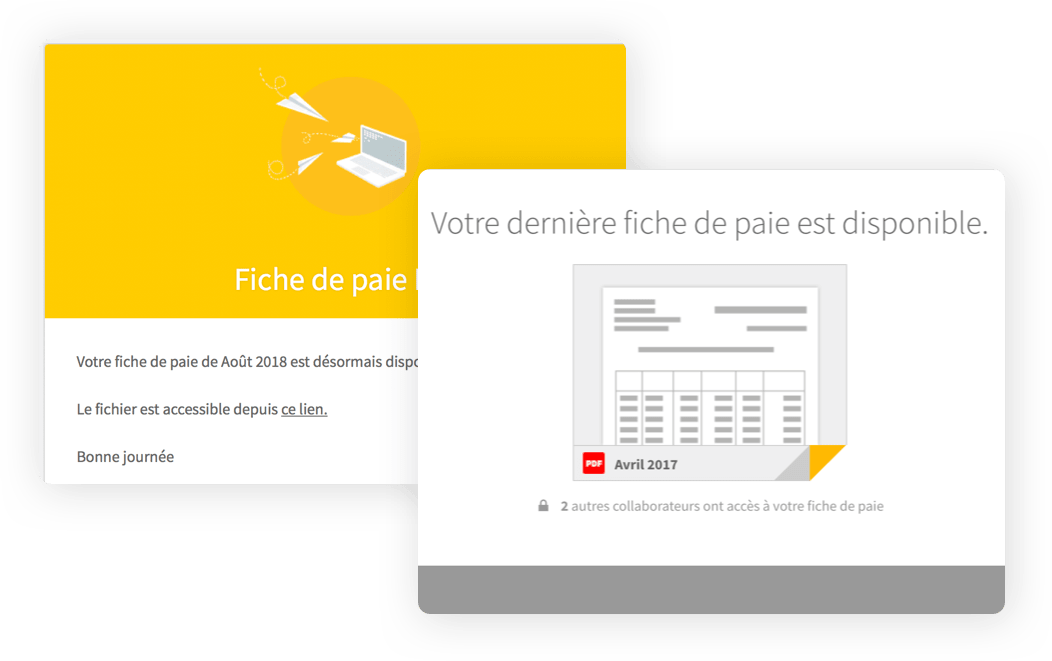

No more printing and wasting paper. Thanks to electronic pay stub software, you can distribute pay stubs automatically and securely by PDF to all employees. Employees will receive a monthly notification of the receipt of their pay stub by e-mail or the mobile application.

Store pay stubs securely

All pay stubs are saved and filed in accordance with the current regulations. Every employee can then access their pay stubs via their profile in their personal space whenever they want.

Reassure your employees

We guarantee the confidentiality of your employees’ data thanks to secure access to the pay stub space by two-factor authentication. Your employees can then access their pay stubs by clicking on the notification received by e-mail or the alert on the platform.

Improve your HR management

Eliminate both the risk of error and the distribution of pay stubs thanks to this pay stub digitalization software. You no longer need to deal with putting pay stubs in envelopes, distributing them and dealing with complaints, and you can get on with higher value-added tasks while reassuring your employees.

Electronic Pay Stub Software Buyer's Guide

What is pay stub software?

Pay stub software is a digital solution that automates the generation and management of employee pay stubs. It saves businesses time and manual effort by handling the intricate calculations associated with payroll, including tax deductions, overtime, bonuses, and other add-ons or deductions.

The software ensures accuracy in these calculations, mitigates the risk of errors, and enables straightforward record-keeping. It often comes with features like direct deposit, electronic pay stub distribution, and integration with other HR or accounting systems. This technology not only simplifies the payroll process but also ensures compliance with payroll regulations.

The benefits of electronic pay stub software

Improved Payroll Accuracy

An outstanding benefit of pay stub software is its ability to boost payroll accuracy. Manual payroll calculations are time-consuming and prone to errors, which can potentially lead to costly penalties and dissatisfied employees.

Pay stub software uses advanced algorithms to automate these calculations, thereby reducing the possibility of human error. Moreover, it automatically updates to reflect any changes in tax laws or regulations, ensuring your business remains compliant at all times.

Cost Savings

Using pay stub software can significantly reduce the operational costs associated with the payroll process. By automating calculations and record-keeping, it eliminates the need for hiring additional staff or outsourcing payroll management.

Moreover, it can prevent costly errors that might occur in manual calculations. The software pays for itself over time, making it a cost-effective solution for businesses of all sizes.

Enhanced Employee Access

Electronic pay stub software also enhances employee access to crucial payroll information. Employees can log in to the system at their convenience to view their pay stubs, check their deductions, and track their earnings.

This transparency can improve employee satisfaction and trust in the company. In addition, this self-service feature saves time for HR staff, as they no longer have to handle numerous inquiries about pay and deductions.

Key components of electronic pay stub software

Pay Stub Generation

Pay stub generation is a critical feature of pay stub software. This feature streamlines the process of creating, organizing, and distributing employee pay stubs. Employers simply need to input employee hours, wage rates, and other pertinent information, and the software does the rest.

It calculates net pay after considering taxes, deductions, and other adjustments automatically. This not only accelerates the payroll process but also reduces the chances of errors that can occur with manual calculations.

Secure Online Delivery

Security is paramount when dealing with sensitive payroll information. Pay stub software typically includes secure online delivery features to ensure the confidential data remains protected.

Pay stubs are delivered to employees via secure online portals, email, or other forms of encrypted electronic delivery. This method of delivery not only offers convenience but also enhances security by minimizing the risk of lost or stolen paper stubs.

Employee Self-Service

The employee self-service feature allows employees to access and manage their own payroll information. They can view their pay stubs, track their earnings history, check their tax deductions, and even download their pay stubs for personal record-keeping.

This feature promotes transparency, reduces the workload on HR, and empowers employees by giving them direct access to their personal payroll data.

Compliance and Reporting

Compliance with local and federal payroll laws is a major concern for businesses. Pay stub software aids in maintaining compliance by staying updated with the latest tax laws and payroll regulations.

In addition, the software can generate comprehensive reports that provide detailed insights into payroll operations, helping businesses make informed decisions and ensure they meet all regulatory requirements.

How much does pay stub software cost?

Pricing Models

The pricing for pay stub software varies significantly based on the pricing model adopted by the software provider. Two of the most common models include Subscription-Based Pricing and Pay-Per-Use Pricing.

- Subscription-Based Pricing: Under this model, you pay a consistent monthly or annual fee for access to the software. The fees often vary based on the number of employees and the level of functionality you require. Many providers offer tiered plans, so you can choose a level that best suits your needs and budget.

- Pay-Per-Use Pricing: In contrast, some providers charge a fee each time you use the service to generate and distribute pay stubs. This model can be cost-effective for small businesses with few employees or businesses that don’t generate pay stubs frequently.

Cost Factors

Several factors can influence the cost of pay stub software, including:

- Number of Employees: The number of employees you have is a significant determinant of the cost you’ll end up paying. Many pay stub software providers charge on a per-employee basis.

- Functionality: The cost can also vary depending on the range of features you require. More advanced features like integrations with other HR systems, detailed reporting, or custom branding options can increase the price.

- Compliance Requirements: Businesses with complex compliance requirements may need to purchase higher-tier plans that include advanced reporting and auto-updating tax tables.

How to choose the best pay stub software

Assessing your Organization’s Needs

The first step in choosing the right pay stub software is to assess your organization’s specific needs. You need to identify the challenges in your current payroll process that you aim to address with the software.

Key considerations include the size of your organization, the complexity of your payroll, frequency of pay cycles, and any unique compliance requirements. A clear understanding of your requirements will guide you in selecting a solution that offers the right mix of features, scalability, and pricing for your business.

Integration with Payroll Systems

The ability of the pay stub software to integrate seamlessly with your existing payroll systems is crucial. This ensures a smooth transfer of data between systems, simplifying your payroll process, and minimizing the risk of errors due to manual data entry.

It also allows for real-time updates across systems, ensuring accuracy and consistency of payroll data. Therefore, consider software that offers strong integration capabilities with popular HR and accounting systems.

User-friendly Interface

A user-friendly interface in pay stub software greatly enhances ease of use, which is essential for efficient and error-free payroll management. The software should be intuitive and easy to navigate, even for non-technical users.

Look for a clean, well-organized interface with clearly labeled features and functions. In addition, consider whether the software offers any training or support to help users familiarize themselves with the system. Remember, a software that’s difficult to use can lead to mistakes and inefficiencies, negating many of the benefits of automation.

Emerging trends in pay stub software

Mobile Pay Stubs

A significant trend in the pay stub software industry is the rise of mobile pay stubs. This innovation comes in response to the increasing use of mobile devices in the workplace and the growing demand for on-the-go access to information.

Mobile pay stub apps allow employees to view their pay stubs and track their earnings anytime, anywhere, straight from their smartphones or tablets. This not only enhances convenience for employees but also caters to the evolving digital habits of the modern workforce.

Employers can also benefit from this feature, as it often comes with additional capabilities, like push notifications for new pay stubs, fostering timely communication and transparency.

Enhanced Data Security

As pay stub software handles sensitive personal and financial data, enhanced data security is a top priority. The trend is towards increasingly robust security measures, with software providers investing heavily in advanced encryption technologies, two-factor authentication, and secure servers.

Some are even turning to blockchain technology for an extra layer of security. These efforts aim to ensure that payroll data remains confidential and safe from cyber threats, giving businesses and their employees peace of mind.

Pay Stub Analytics

Another emerging trend is the integration of analytics in pay stub software. These tools offer detailed insights into payroll data, highlighting trends, identifying anomalies, and facilitating strategic decision-making.

For instance, businesses can use analytics to track overtime trends, compare wage costs across different departments, or monitor the impact of salary changes. This data can be incredibly valuable for HR and finance teams, helping them optimize payroll processes, forecast costs, and manage budgets more effectively.

As businesses continue to embrace data-driven operations, the demand for pay stub analytics is set to grow.

Why choose a pay stub tool through PeopleSpheres?

Choosing a pay stub tool through PeopleSpheres brings numerous advantages that enhance flexibility and integration in your HR processes.

Freedom to Choose

Our platform prioritizes giving businesses the freedom to choose the tools that best fit their specific needs. We understand that every organization is unique, with different payroll complexities and requirements. Hence, we offer a broad array of pay stub tools, allowing you to select the one that aligns best with your payroll needs.

Seamless Integration

At PeopleSpheres, our primary goal is to streamline and simplify your HR processes. And we understand that seamless integration is key to achieving this. Therefore, all our pay stub tools are designed to integrate smoothly with all other HR tools in your system. This ensures a seamless flow of data across platforms, reducing the chances of errors, and saving you valuable time.

Flexibility to Change

We believe in flexibility and adaptability. With PeopleSpheres, you are not locked into a long-term commitment with a tool that may not continue to serve your needs. You have the freedom to remove or switch tools anytime you find it necessary. This ensures that as your organization evolves, your pay stub tool can evolve with it, always providing the best solution for your changing needs.

In conclusion, choosing a pay stub tool through PeopleSpheres means gaining a solution that is customizable to your needs, integrates seamlessly with your system, and can be easily changed or replaced as needed. This results in a more efficient and flexible payroll process for your organization.

Retailer unifies their HR systems for greater efficiency across 220 stores

Discover how Adopt, a major player in the French retail sector, transformed their HR processes with PeopleSpheres. By unifying disparate HR systems into one seamless platform, they achieved greater efficiency, enhanced employee experience, and empowered their teams to thrive.

Ready to get started ?

Let us guide you in choosing the best software for your business

Learn how to swiftly tackle HRIS selection challenges

Learn how to swiftly tackle HRIS selection challenges![Speed Up your HRIS Search - And Check Every Item off your List [Checklist Included]](https://peoplespheres.com/wp-content/uploads/2023/11/Speed_Up_your_HRIS_Search_And_Check_Every_Item_off_your_List_Checklist_Included_white_paper_visual.png)