Payroll Software

Automate payroll management to save time, cut costs, and reduce errors by integrating payroll software. Conduct paperless and accurate payroll processing on the PeopleSpheres platform where HR and payroll software are tied together as one.

Your connected tools

Master payroll management simply with the various tools offered by PeopleSpheres.

Silae

TeamsRH (Payroll)

Nibelis

Paybix

ADP

SDWorx

Sage

HR Access

Cegid

Listopaye

UKG (Payroll)

Discover all the tools connected to PeopleSpheres

See all the toolsPre-filled data

Save time with pre-filled pay slips with data already entered in the PeopleSpheres HR platform.

Access on any device

Access payroll software on all your internet-connected devices.

Automate tasks

Simply automate your payroll procedures and free up time for high value-added tasks.

Better reporting

Use your data to easily create personalized dashboards.

Automated and efficient payroll management

Create alerts

Receive notifications when pay stubs are received.

Personalization

The module adapts to the situation of each employee by taking into account their employment contract and its specificities.

Export HR data

Export your HR data quickly and efficiently to better use it and create dashboards.

Compliance

Create pay slips with peace of mind and be compliant without worrying about legal updates.

Worry about legislation no longer

Payroll software offered in our human resource platform, which is compatible with and recognized by the DNS, is automatically updated with respect to your legal and contractual obligations. To reduce your liabilities and ensure that you are even more aware of your obligations and tax compliance, we offer summary sheets with helpful paperwork on each legal obligation. With our payroll services, you no longer need to worry about legislation and tax liability, as we help you to always be in compliance with your payroll process. In the case of non-compliance with regulations, our management software sends you a notification electronically, so that you can correct it as soon as it appears to avoid any costly tax penalties.

Protect your sensitive data

All your payroll data is stored in the payroll software and encrypted in HTTPS, thus guaranteeing security and confidentially. The servers on which your information is stored are highly secured by our HR software. To avoid the loss of any data or payroll details, backups are performed 4 times per day.

Become more efficient by automating your payroll processes

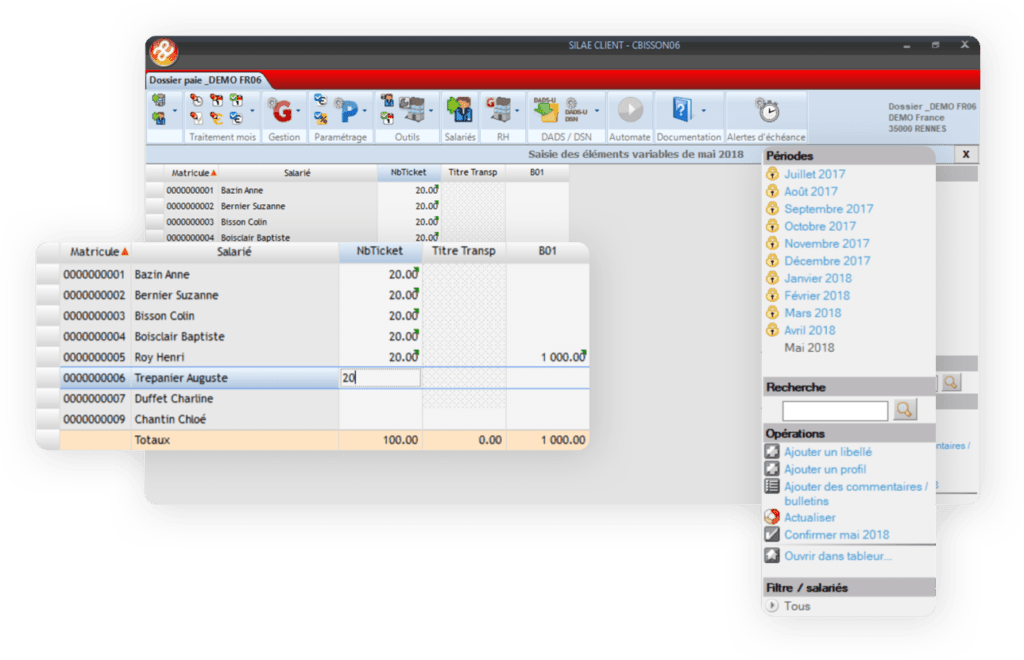

Each user is automatically created in the HR platform and appears in the payroll software, where each section is automatically pre-filled with user information from other integrated software. For example, data registered in the employee leave software is automatically transmitted to the payroll system to reduce re-entering of data, which makes your job easier and saves you time. The automated payroll software also lets you manage payroll and its variable elements, as well as social declarations.

Gain control over your payroll processing

With payroll software integrated into the PeopleSpheres platform, the processing of payroll is made easy. You can effortlessly correct your errors, make changes, and recalculate your employees’ pay stubs at any time. The payroll management system also allows you to create alerts to remind you of important deadlines. For example, our platform can send you reminders of the expiry of residence permits, trial periods, and more. You also have access to customized dashboards and social reports to give you a clear overview of your HR payroll data.

Simplify your HR management

Accelerate your administrative management thanks to the interconnection of the different HR solutions. The payroll software can retrieve the data entered into another software of the HR department. For example, the payroll function can retrieve data from the leave & absence and time & attendance software, which allows for auto-fill of the different sections in the payroll system, thus saving you time and effort. With the consolidation of your different management systems, managing payroll becomes easier and you can be ensured to deliver your pay stubs on time every month.

Payroll Software Buyer's Guide

What is payroll software?

Payroll software is a digital solution that automates the process of paying a company’s employees. It calculates salaries, deducts taxes, applies benefits, and ensures that payments are distributed correctly and on time. Payroll software simplifies payroll management for businesses, allowing them to streamline their workforce management. This technology can also generate pay stubs, manage tax forms, and maintain accurate records for auditing purposes.

Payroll software not only streamlines the payroll process, reducing potential human errors, but also ensures compliance with various laws and regulations related to employee compensation. Payroll systems often offer features that streamline payroll processing, ensuring small business owners have a comprehensive solution for their payroll needs. This includes managing payroll-tax filings, garnishments, and year-end payroll requirements, making it an excellent option for small businesses seeking an efficient and cost-effective payroll service.

The benefits of payroll software

Reduced Payroll Errors

One of the significant advantages of using payroll software is the reduction in payroll errors. Automation minimizes the risk of human error, which can lead to costly mistakes and employee dissatisfaction. By automating calculations and data entry, payroll software can significantly enhance accuracy and ensure that your employees are paid precisely what they’ve earned.

Enhanced Compliance and Tax Filing

Payroll software simplifies the complex task of staying compliant with employment and tax laws, which vary widely and change frequently. The software is updated regularly to reflect these changes, ensuring your business always remains in line with the latest regulations. It also automates the tax filing process, saving time and reducing the potential for errors.

Employee Empowerment with Self-service

Payroll software often includes a self-service portal, empowering employees to access their payroll information whenever they need it.

This feature allows employees to view their pay stubs, check their benefits, and even update personal information without needing to contact HR. This leads to greater transparency, boosts employee engagement, and frees up the HR department to focus on more strategic tasks.

Key components of a payroll software

Payroll Processing and Calculation

The core feature of any payroll software is payroll processing and calculation. This component automates the complex task of calculating each employee’s salary based on their hourly rate or salary, the hours they’ve worked, and any overtime, deductions, or bonuses.

This feature not only speeds up the payroll process but also reduces the potential for mistakes that can occur when these calculations are done manually.

Tax Management and Compliance

Another critical feature of payroll software is tax management and compliance. This feature manages all aspects of payroll taxes, from calculating the correct amount of tax to be withheld from each employee’s paycheck to filling out and submitting the necessary tax forms. It also keeps track of changes in tax laws and regulations, ensuring that your company remains compliant and avoids costly penalties.

Employee Record Management

Employee record management is a feature that allows for the efficient storage and management of employee information. This includes personal details, employment history, salary details, benefits, and tax information. Having this information centralized and easily accessible not only simplifies the payroll process but also aids in maintaining accurate records for auditing purposes.

Reporting and Analytics

The reporting and analytics feature provides useful insights into your payroll activities. It allows you to generate various reports, such as salary summary, tax reports, overtime reports, and more.

These insights can be invaluable for making informed business decisions, budgeting, and strategic planning. This feature also helps ensure transparency and assists in auditing processes.

How much does payroll software cost?

Pricing Models for Payroll Software

There are typically two primary pricing models for payroll software – subscription-based and per employee. In a subscription-based model, users pay a flat monthly or annual fee for access to the software. This fee often includes updates, support, and a certain number of users or employee records. The per employee model, on the other hand, charges based on the number of employees processed through the software. This can be more cost-effective for smaller businesses but can add up as the company grows.

Factors That Affect the Cost of Payroll Software

Several factors can influence the cost of payroll software. One of the most significant is the size of your company. As mentioned above, if you’re paying on a per-employee basis, more employees mean higher costs.

The complexity of your payroll can also impact the price. If you have many different pay rates, benefits packages, or complex tax situations, you may need a more advanced (and therefore more expensive) software. Additional features, like HR management or time tracking, can also add to the cost.

How to choose the best payroll software

Assessing Your Organization’s Needs

To choose the best payroll software, start by assessing your organization’s needs. Identify your payroll processes – how complex are they? Do they involve different pay rates, benefit packages, or tax situations? Determine the size of your payroll: does the number of employees warrant a per-employee pricing model or a flat-rate subscription?

If you have a large team with a simple payroll, subscription-based pricing may be more cost-effective. Conversely, a small team with a complex payroll may benefit from a per-employee model. Also small business owners can use cloud-based online payroll services. This not only saves time and streamlines the process but also ensures accurate withholding and deductions.

Integration with Other HR and Accounting Tools

Next, consider the software’s capability to integrate with other HR and accounting tools already used within your organization. Seamless integration will create a unified system for all your HR processes, enhancing efficiency and reducing the chances of data discrepancies. For instance, integration with time tracking tools can automatically feed into the payroll software, ensuring accurate payment for hours worked.

Ease of Implementation

Lastly, take into account the ease of implementation. The best payroll software for your organization should be easy to install, use, and troubleshoot.

Consider if the software provider offers adequate support during the setup process, as well as ongoing customer service. Remember that a user-friendly interface can greatly improve the experience for your HR team, reducing the time spent on managing payroll and increasing the time available for other strategic tasks.

Emerging trends in payroll software

Mobile Payroll Access

One of the emerging trends in the payroll software landscape is mobile access. As smartphones become increasingly prevalent, the desire for mobile-friendly payroll solutions grows.

Mobile access allows employees to view pay stubs, check benefits, and even update personal information on their devices, anytime, anywhere. This means greater convenience for employees and less administrative work for HR departments. Plus, with push notifications, employees can be informed immediately when they are paid, enhancing transparency and employee satisfaction.

AI-Powered Payroll Processing

Artificial Intelligence (AI) is making waves in many industries, and payroll is no exception. AI-powered payroll processing can automate more complex tasks and provide more accurate results.

For example, AI can learn from previous data to predict future payroll costs, overtime, and even potential compliance issues. This not only enhances accuracy and efficiency but also allows HR teams to be more proactive and strategic in their planning.

Blockchain for Payroll Security

Blockchain technology is also beginning to change the way payroll is managed. Known for its advanced security features, blockchain can create a secure, decentralized record of all payroll transactions.

This eliminates the need for intermediaries, reduces the risk of fraud, and ensures the integrity of payroll data. Plus, with the ability to process cross-border payments efficiently and transparently, blockchain technology could be particularly beneficial for companies with international employees.

But, like all new technologies, blockchain in payroll is still in the early stages and requires further development and legal clarity.

Why choose a payroll tool through PeopleSpheres?

PeopleSpheres is an ideal choice for businesses seeking an efficient payroll tool due to its versatile platform that integrates all your HR tools into one cohesive system.

Having all HR-related data in one place reduces discrepancies, simplifies processes, and enhances efficiency. It supports the centralization of employee data and allows for smooth data flow between different applications, eliminating the need for multiple entries of the same data.

Furthermore, PeopleSpheres offers a user-friendly interface and exceptional customer support to ensure a seamless user experience. Its compatibility with numerous popular HR tools ensures it can blend into your business ecosystem effortlessly. PeopleSpheres is also known for its commitment to data security, ensuring your sensitive payroll information is well-protected.

Made up of 18 brands, operating more than 3500 salons and boutiques in more than 35 countries across 5 different continents., Provalliance aims to double its revenues, a goal that comes with many challenges and ultimately, the need to digitally transform its business.

Discover how a large multinational like Provalliance quickly went from a fractured HR tech stack to a unified ecosystem with PeopleSpheres.

Download the product sheet to learn more about our HR portal

Payroll software features

Protect your sensitive data

The PeopleSpheres HR solution allows you to be certain of the security and confidentiality of your data. The servers on which your information is stored are highly secure. In order to avoid the loss of your data, backups are made 4 times a day.

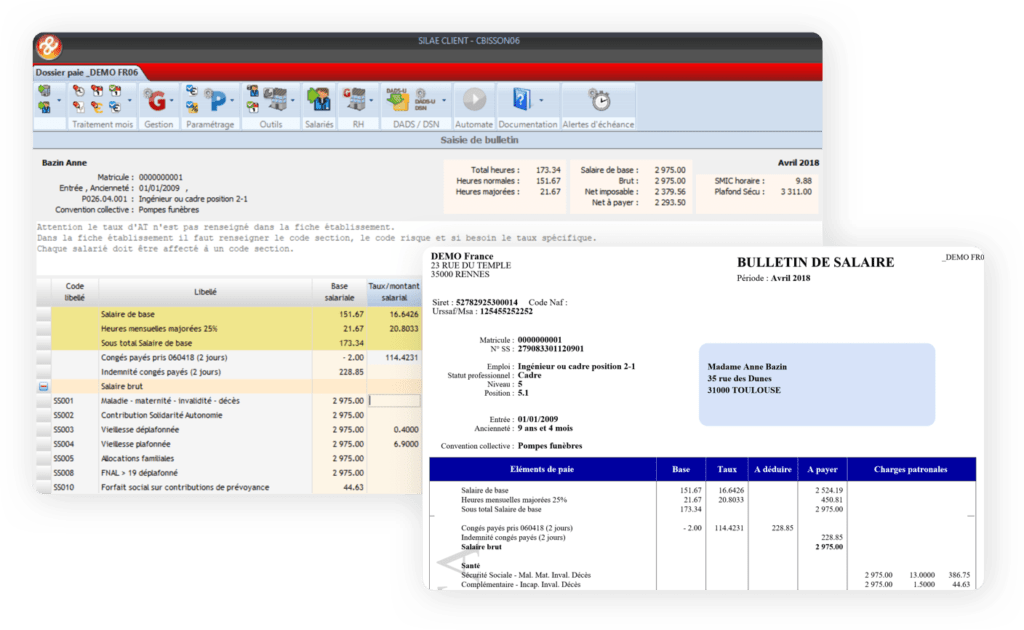

Take advantage of automatic legislative updates

Stay assured that your cloud-based payroll software is in line with regulatory and legal updates. Software developments related to these updates are anticipated to allow you to manage your employee payroll with peace of mind. You can also manage multiple collective bargaining agreements which can be updated over time to guarantee you a business payroll that is always compliant (pay rates and pay increases of employees, bonuses, rate of contributions, pay slips, specific contracts, paid holidays, job classifications , etc.)

Integrate data from other HR software

With our easy-to-use human resources platform, we provide payroll software that is interconnected with all your other management solutions; you no longer need to re-enter data from one software to another. For example, data from the leaves & absences and time management systems is automatically transmitted to the payroll system to make your job easier and save you time. With a centralized dashboard, you can also use your payroll software to seamlessly manage various payroll elements which can often rely on other HR functions that are outside of payroll administrators’ hands, such as recruiting, onboarding, shift scheduling, and merit-based pay raises .

Pay your people with ease

For HR administrators

- Simplify your payroll management

- Save time with automated payslips

- Facilitate and automate your time-consuming tasks

- Improve your reporting with dashboards

Equipped with payroll software, HR administrators no longer have to be stressed about processing their employees’ payroll. Payroll management is easy thanks to automated forms and scheduled alerts for recurring tasks. Dashboards and reports are available to allow the administrator to better visualize payroll-related data and optimize its management for improved HR management.

For employees

- No more errors on pay day

- Ensure the security and confidentiality of their data

Thanks to payroll software, your employee will no longer have any difficulty finding and viewing their pay slips. Avoid errors on pay stubs. Each month, the employee receives their clear and precise pay stub, kept securely in a confidential space.

More on how to improve your payroll process

Less time-consuming payroll

Payroll management turns out to be a complicated task because many conventional and legal obligations surround it. However, it is the most important task in human resources management since it allows you to retain, motivate your employees and make your business function. PeopleSpheres helps you with your payroll management thanks to a dedicated module that is constantly up to date with your legal obligations and recognized for DNS: no longer worry about these regulations, PeopleSpheres takes care of them and alerts you if you do not comply with them.

Each employee and each situation is different and PeopleSpheres offers you the possibility of managing all these situations using a single module. All types of contracts are taken into account: CDI, CDD, Internship, apprentice or work-study, part-time… which allows you to avoid juggling between several software programs. Automate your procedures by selecting the important criteria that must be taken into account in your payroll management. No need to enter data by hand anymore, PeopleSpheres automatically retrieves it from your other modules, such as the Leave & Absences module for example, in order to integrate it into your payroll management.

Finally, PeopleSpheres secures your data since all data recorded in the payroll module is encrypted using HTTPS encryption and is stored on secure servers. Backups of your data are made 4 times a day to avoid loss.

More accurate processing

No need to re-enter each user, create the user once for all our different modules. All data relating to a user is thus transmitted from module to module.

Access personalized dashboards giving you greater visibility on your payroll management. Quickly spot potential errors and quickly recalculate each employee’s pay slip in the event of an error or modification. This payroll management module allows you to automate your HR processes and save time in your administrative management.

Consider digitalizing your pay slips in order to reduce your paper printing and begin the administrative digitalization of your business.

Digitalize and go paperless

Digitizing all payroll management is becoming more and more of a necessity in a world where digital is taking up more and more space. Your employees expect significant administrative simplification and this is what PeopleSpheres will offer them.

Your employees can receive their pay slips virtually thanks to the payroll module connected to the pay stub digitalization module. No more paperwork and lost pay slips: all their pay slips from the last 5 years are stored virtually and they have access to them whenever they want.

Ready to integrate payroll software?

Our teams accompany you in the process of making payroll automated

Learn how to swiftly tackle HRIS selection challenges

Learn how to swiftly tackle HRIS selection challenges![Speed Up your HRIS Search - And Check Every Item off your List [Checklist Included]](https://peoplespheres.com/wp-content/uploads/2023/11/Speed_Up_your_HRIS_Search_And_Check_Every_Item_off_your_List_Checklist_Included_white_paper_visual.png)