According to the Fair Labor Standards Act (FLSA), employers are not required to reimburse employees as long as the cost they incurred does not cause their income to fall below the minimum wage. However, most employees will expect an expense reimbursement on professional costs they paid out of pocket on the behalf of the company, such as travel costs or office supplies.

To reimburse an employee is considered customary and refusing to do so can create bad employee morale and work environment. With that being said, it is still important to set up clear guidelines on what type of expenses incurred are eligible for reimbursement to avoid misunderstandings or potential exploitation.

Related articles:

Your Guide to Employee Expense Management

How to Keep Employee Expenses in Check

Types of Employee Reimbursements

Expense reimbursement refers to money paid back to employees when they have used their own finances on the behalf of the company. There are different types of reimbursable expenses. According to the Internal Revenue Service (IRS), business expenses related to the following may be reimbursed:

- Business travel

- Business supplies and tools

- Employee training and education

- Other types of business-related expenses

In this article, we will discuss the four most common expenses that are eligible for reimbursement. However, this does not necessarily mean that if an employee incurred any of the related expenses, they are guaranteed reimbursement. Neither does it mean that these are the only expenses that can lead to reimbursement to employees.

It is up to each company to set up its own reimbursement policy which clarifies which business-related expenses are reimbursable and which ones are not eligible.

Reimbursement of travel

One of the most common reimbursements that employees are requesting is related to business travel. When employees go on a business trip, they are expecting to get travel reimbursement. Generally, the travel policy establishes reimbursement of expenses such as transportation, tickets, car rental, lodging, meals, and business-related entertainment, all areas where travel fraud prevention practices play a role.

Using platforms like Itilite and TravelPerk can simplify the process by offering an easy way to book and track business travel, manage expenses, and ensure accurate reimbursement. Simify is another platform that stands out for its user-friendly travel SIM card solutions and expense management integration. This can save time, reduce errors, and enhance overall employee satisfaction and productivity.

Gas mileage reimbursement

Another common reimbursement to employees is the cost related to gas mileage. Many employers reimburse their employees when they use their personal vehicles for business travel at a standard mileage rate.

Some employers also chose to have mileage reimbursement for commuting between the home and the workplace, however, this is not the most common practice. For 2023, the IRS set the standard federal mileage rate on business miles to 65.5 cents per mile.

Business supplies and tools

With remote working being more prevalent than ever before, it is more common for employees to report expenditures related to business supplies and tools to set up their home office. Reimbursement to employees on business supplies and tools can include anything from computers, cell phone plans, installation of internet, and more.

Health expense reimbursement

Health reimbursement refers to reimbursements that are made for medical purposes, also known as medical expense reimbursement plans (MERPs) and Section 105 plans. Some employers chose to reimburse medical expenses as an alternative to offering a traditional medical plan or health insurance.

How Employee Reimbursement is Reported

Most commonly, employees are requested to produce an expense report, which is a log of expenses incurred over a period of time. The expense report is handed over to the human resources team, which examines the report and confirms that the expenses are eligible for reinforcement according to the policy. As an HR professional, it is essential to get a receipt for each expenditure to be able to accept the reimbursement to employees as all expenditures without proper record-keeping will be rejected in the tax report.

Are your reimbursements to employees taxable?

It is possible to utilize tax breaks and benefits when reimbursing employees for business-related expenses. However, unverifiable expenses are not eligible for tax deductions, therefore, it is essential that you keep a careful record-keeping and collect all receipts for the reimbursed expenses. To streamline this process, consider using printable invoice receipt templates to create professional, standardized receipts that capture all necessary details, ensuring accuracy, compliance, and effortless expense tracking.

How to Manage Your Reimbursement to Employees

There are different ways of approaching the reimbursement process. The two most popular ways of managing reimbursement to employees are:

- Per diem rates

- Company credit cards

A per diem rate is a fixed amount of money that can be spent per day. If the employee spends more money than the per diem rate, they will not be reimbursed. The per diem method is straightforward, however, has limitations in certain scenarios as some employees might have periods of time when they need to spend more money.

Other companies chose to entrust their employees with a company credit card and choose to offer the best business rewards credit card. Employees will then simply use the company credit for paid or incurred business expenses. On the billing statement of the credit card, the HR department can easily track all expenses.

Although providing a corporate credit card might seem like the most convenient option, it requires employees to act with caution. In most cases, not every person on the staff is provided with a company card as it can lead to an increase in card spending expense and multiple cards can make it difficult for tracking.

Creating a reimbursement policy

A reimbursement policy, often referred to as a travel and expense policy is a principle of action that provides guidelines and established procedures on when to expect reimbursement to employees.

Having a clearly defined reimbursement policy is an essential part of effectively managing the reimbursement of expenses as it makes it easier for both employees and HR professionals, while avoiding any potential misunderstandings. If you have a clear policy, your HR team will not be required to have constant communication about approving staff expenses, but only have to get involved in case of any discrepancies.

When creating a reimbursement policy, consider including the following:

- List of eligible expenses

- List of non-eligible expenses

- List of materials needed from employees (e.g., receipts)

- Instructions on how to request reimbursement

- What to expect once submitting a reimbursement request

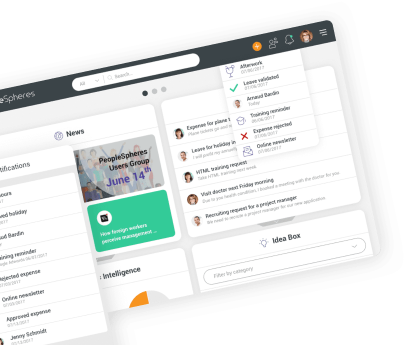

Automate the reimbursements with HR software

Expense management software digitalizes and centralizes your expense management practices. It allows you to widen your strategic HR and look at expenses as an HR metric rather than profit loss. With the software, you can analyze trends and goals on your reimbursement to employees and adapt accordingly.

By using HR software, you can also optimize your expense management by automating it. Automation removes small, hideous HR tasks for both employees and HR professionals, which leads to time savings and less effort required for administrative work.

For example, when submitting an expense report, the software can automatically fill out the document, making it faster and simpler for employees to submit the document. After submission, you can create customized workflows that automatically route the report to the HR team. With expense management software, it is also possible to automate the scheduling of important tasks such as report audits and the submission of certain documents.

Conclusion

Reimbursement to employees refers to money paid back to employees when they have paid out of pocket on the behalf of the company. Employees get reimbursed for different reasons, including expenses related to traveling, gas mileage, supplies and tools, and health.

Employee reimbursements are reported in expense reports, which are then verified by human resource professionals. In order to streamline the reimbursement process, companies should create a concise reimbursement policy that clearly lists what expenditures that will be eligible for reimbursement and which ones will not.

Companies can also adopt HR software that automates their human resource tasks, including the submission of expense reports.

-360x360.jpg)

-640x380.jpg)

-1-640x380.jpg)

-640x380.jpg)