Managing employee expenses has increasingly become a priority for companies, especially during economically challenging times. There are various ways for businesses to take control of and optimize the management of their employee expenses and ensure that employees are not being overly enthusiastic when spending company money.

Furthermore, it is extremely important to ensure that accurate and detailed records of employee expenses are kept in case of future audits.

Related articles:

5 Tips to Adjust Compensation and Performance

Take Control of the Management of Employee Expenses

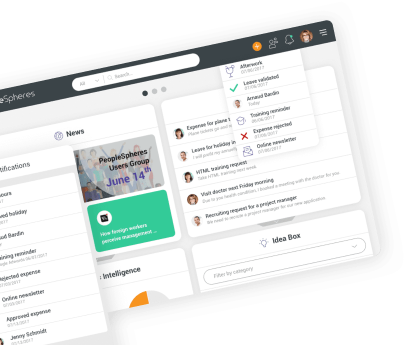

Having a good software for the management of employee expenses is key, since it can prohibit employees from entering false expenses or expenses that are in breach of company policy. Automating the process makes employee expense reporting a lot quicker and easier. This is especially true when managers avoid making decisions and conflict arises about whether expenses and reimbursement should be accepted or not, particularly from difficult or more senior members of staff.

When employee expenses are entered directly into the software, there are no embarrassing confrontations or disgruntled staff since bogus expenses claims will not be entered in the first place.

Make sure that expenses claims are routed appropriately based on criteria such as expense type, value or project. The amount of the expenses also comes into play. For example, if it is less than $1,000, the notification could be sent to the line manager for validation. Expenses claims above $5,000 could be validated by the managing director, etc..

The reason and nature of the employee expenses is also important. For example, if an employee tries to claim for a taxi home when there was no legitimate reason for him to take a taxi rather than public transport, this employee expenses could potentially be flagged in the software for closer examination.

Make Employee Expense Claims Visible

Letting employees see the details of their claims could have an impact on their spending behavior and thus reduce wasteful spending. If money is spent pursuing a new client or keeping an existing one happy, this would be considered as an appropriate expenditure, but showing the cost of these activities is also useful as it shows the company the cost of customer pursuit or retention versus the amount the said customers bring in.

This visibility can be extended to display not only individual expense claims but collective ones as well, showing information at departmental or organizational level so it is easier to compare the expenditure per department and the total amount the company pays out in expenses.

Keep the Business of Employee Expenses Simple

It is important that the software is not overly complicated and difficult to understand and use as this will put employees off and will breed frustration. Keep the fields to be filled in regarding employee expenses to a minimum and make sure there are not dozens of pages and unnecessary boxes to be ticked or filled in. After all, the whole point is to simplify the management of employee expenses for everyone involved.

Consider an expense management tool that offers a robust mobile app. This allows employees to submit expenses on-the-go, perhaps snapping a photo of a receipt and uploading it directly to the app. For those who prefer a more traditional approach, utilizing cash rental invoice receipt templates can provide a clear and organized way to track and record expenses. Mobile capabilities mean that expenses can be recorded and submitted at the moment they occur, which is not only convenient for the employee but also means faster processing and reimbursement.

By focusing on simplicity and functionality in your expense management software, you ensure that the process detracts as little as possible from the day-to-day responsibilities of your team. A streamlined, user-friendly system encourages timely submissions, reduces errors, and keeps everyone focused on their primary roles without unnecessary administrative distractions.

-360x360.jpg)