Since the start of the pandemic, hiring has been unorganized, unstructured, and difficult. Companies are struggling to find talent domestically and are looking internationally to solve their problems.

In 2021 alone, studies have found that employers have cited talent shortages to be the biggest issue they face. As organizations continue to deal with the lingering effects of the pandemic, they continue to develop and expand their “virtual workforce” outside of their home offices. Alongside this expansion comes various struggles and unsolved problems.

In an environment where managing an international workforce is becoming mandatory for many, the guidelines and solutions are far and few in the payroll department. Dealing with compliance, payroll, tax filings, and other issues that are taken as amenities domestically, are starting to creep up on businesses. This is why having a robust international payroll service and a managing service like PeopleSphere’s global HR system, is vital to continue running the HR department seamlessly and efficiently.

Related Articles:

What You Need to Know about Pay Transparency

5-Step Plan for Getting a Handle on Pay Equity Issues

What is International Payroll

International payroll isn’t simply processing company payroll to your workforce. An international payroll solution is your gateway to building and alleviating pressures for international HR. This includes global payroll, hiring, training, and more. Payroll services should save you time and money by letting you spend your time on what matters most while ensuring all the intricate legality, compliance, and other financial implications are taken care of.

When dealing with international payroll, there are plenty of factors to look out for:

Employee Pay by Country

Workers compensation for employees abroad varies drastically. What is normal in one country may not be 50 kilometers south of the border. Maintaining minimum wage requirements, holidays, paid time off, and certain traditions like extra pay or bonuses at the end of the year are all factors to keep in mind when managing international payroll.

Additionally, countries have different time zones and pay periods, so one payroll process might not look like the other. While it may be normal to pay bi-weekly domestically, perhaps workers expect weekly pay internationally. Not to mention how workers get paid. Either bank transfers, direct deposit, or even cash in certain situations. All these things should be accounted for with an international payroll. To ensure transparency and efficiency, it’s essential to generate accurate and detailed payment records, utilizing standardized cash receipt invoice templates that cater to diverse regional requirements and regulations, thereby facilitating smooth financial transactions and maintaining positive relationships with a global workforce.

Laws and Regulations

Looking at laws and regulations, entering new markets will definitely impact the complexity and scale of judicial issues regarding employment laws and working conditions. When you hire an employee in another country, you’ll have to keep in mind that you are complying with:

-

Tax laws and collection policies

-

Employee benefits

-

Minimum wages

-

Working hours

-

And more

HR Expansion

Lastly, as you grow internationally, you will have to grow domestically. In essence, as you employ more people, you will need more people to manage these people. Whether it be for employee experience or onboarding procedures, the workload for your HR division will greatly increase. This is why it’s important to incorporate automated technologies like an integrated HR platform such as the one PeopleSpheres provides in order to simplify the process. With its ability to connect to countless HR tools, stay in compliance, and reduce the need to outsource or increase HR burden, the PeopleSpheres HR platform will seamlessly integrate and be your centralized, single point of contact HR tool.

While there are more factors to consider like data protection, exchange rates, and others, the aforementioned are some of the more important things to examine in order to build an intuitive global payroll system.

What does Global Payroll Include?

International Employment

If your company hires employees from a country where you don’t have a registered office or legal entity, you will need comprehensive employment management services. Certain international payroll providers can help you accomplish this through something called Employer of Record (EOR). With EOR services, essentially all that happens is that the global payroll provider acts as the “employer” on paper but the employees still work for your organization. This is quite common practice and is completely authorized. This allows international talent to still be able to work with you and will make sure you are in compliance with any labor laws. However, it’s important to read reviews and evaluate the offerings of different EOR providers before making a decision, ensuring they meet your specific needs.

Contractor Payment

Oftentimes, companies hire international talent, not as employees, but rather as “contractors.” Either for short-term arrangements or for niche, specific tasks, hiring workers as contractors can be quite tricky as different countries classify what a contractor is independently. This is where your global payroll provider should alleviate any strains in your HR systems. A seamless and secure payment solution is essential to ensure timely and compliant contractor payouts, making XPay Payment Gateway the perfect choice for global businesses.

However, it isn’t this simple most of the time. Companies usually use a whole host of methods in varying countries. They could have a domestic entity that is handled by the payroll provider, while also deploying them as international payroll providers for your international employees, and then you may also use them to manage contracts abroad. No matter the complexity, a reputable international payroll provider will be able to smoothly integrate and offer the best, personalized services for your situation. Having a well-defined payment strategy in place will further ensure smooth payroll operations and compliance.

How to Manage Global Payroll

When looking at the options to manage a global payroll, there are a few major varieties to analyze before choosing one.

Payroll Software

Payroll software is an HR software, usually cloud-based, SaaS platform that will manage, automate and monitor employee payroll. Ensuring that the payroll service is internationally compliant is vital and does cost more, however, it will allow you to scale and grow with peace of mind. Furthermore, global payroll solutions let you automate and outsource parts of your payroll management, while at the same time, being able to oversee and control certain aspects of it. For small businesses payroll or medium-sized businesses just starting to look for international talent, this is the best bet to getting value for your money and the best features.

Hire Global PSP

Another option is to hire a global payroll service provider. First and foremost, payroll outsourcing is the most expensive option. When hiring a global PSP, you will have little to no control over the international HR workings as the PSP should completely take over. All your responsibilities and your entire payroll process will be transferred to the payroll service providers, meaning that you must diligently vet and set clear expectations for them. Handing over employee data and ensuring that they pay the workforce on time accurately, as well as tax payments is a big responsibility to entrust which is why finding reputable payroll companies are very important. If you do decide to go down the route of outsourced payroll, don’t let PSPs take control reign without your say. Coordinate with the payroll company and make sure you perform check-ins or “audits” to make sure they are truly serving your payroll needs.

Decentralized vs. Centralized Payroll Systems

With in-house solutions allowing full control over all key points of the HR system, it requires an expansion in every country you have employees. Moreover, it may strain HR employees in order to meet demand while remaining efficient which could worsen the overall employee experience.

But should you centralize or decentralize your payroll systems if you are processing payroll in multiple countries? In other words, should you use one system to manage payroll for all workers, or should you have one that specializes in each country where you do business?

For each decentralized payroll system, you will need to have someone to manage and process the payroll; make sure each one is compliant and run reports. This is a good way to ensure that you are following the regulations for each country when it comes to paying employees. But when it comes to reporting from several systems and trying to consolidate it to find out labor costs across the organization, it can quickly become a nightmare. Not to mention, emailing payroll reports can be a data privacy and security risk.

On the other hand, centralizing your international payroll can be easier to process, take fewer resources to manage, and will be more secure. But you may be wondering if you will be missing out on the legal specialization aspect? Don’t worry, there is a solution for that.

It’s called a composable HR system.

How Composable HR System Can Help

No matter how many payroll providers you may need to process HR payroll in multiple countries, it’s possible to connect them all to a single platform using a composable HR application. PeopleSpheres HR platform lets you manage your global payroll from one place while still maintaining the specialization needed for each country’s local payroll.

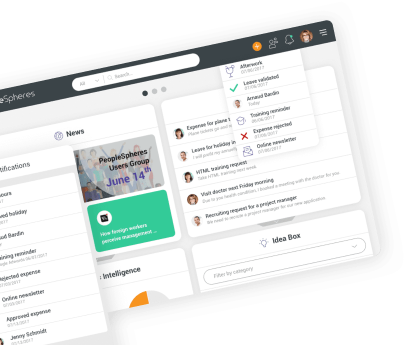

PeopleSpheres smart-connects your existing HR solutions to allow you to transform your workforce and employee experience. Its features enable automating administrative HR processes, visualizing KPIs, and adapting to your legal and contractual obligations, while respecting the GDPR and other data privacy regulations. This unified HR management system will act as a single system of record enabling you to focus on growing your business.

Prioritizing the Employee Experience

As explored in our previous article about the employee experience (EX), this is something employees are demanding to improve. Ensuring that the employee experience is prioritized and making sure that whatever system is used will enhance the work routine for employees should be of utmost concern. Missing, delayed, or even inaccurate payments will rapidly deteriorate the relationship between employees, especially if they are international workers with certain expectations.

-360x360.jpg)

-640x380.jpg)