A good payroll software is a godsend for any business as it means payroll processing will be automated so there is little chance of error, any wildly incorrect numbers accidentally entered will be immediately visible and you will be alerted to any important dates and deadlines. This is why choosing the right payroll software for your company is an important decision.

Related articles:

Payroll Management: Processes and Solutions

How to Effectively Manage International Payroll

The Advantages of Payroll Software

Payroll is a critical operation for every company. Paying staff accurately and on time avoids low morale, poor performance, and even legal problems. And a good automated payroll system helps you to carry out your pay run with greater confidence, efficiency and speed. Adopting payroll software is the solution.

There are many advantages to using payroll software:

- Payroll calculations are worked out quickly

- Accurate pay slips are generated by the software

- Tax calculations are automated by the software so you do not need to work them out yourself, and you no longer need to understand tax legislation since all necessary information will already be entered into the system

- Documents such as pay slips and reports are stored in the software

- Various reports can be generated by the software based on the data stored

- Bonuses, vacation pay, expenses and other items can be calculated in the payroll system

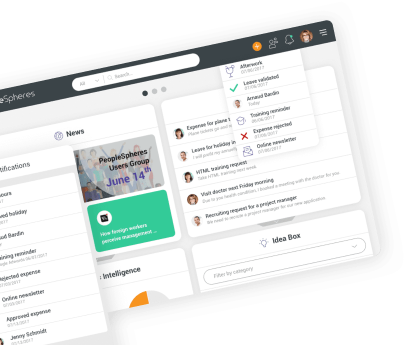

It is also possible with a lot of payroll software to connect payroll to other modules, such as expenses or time and attendance, so information about the hours worked by employees are transferred to the payroll system, thus simplifying payroll calculations.

Extra features

These are basic features that all payroll systems should provide. But some businesses, depending on their size or nature, require extra, customizable elements for their payroll software.

You may want a payroll system that provides self-service to employees so they can request vacation and leave online. Similarly, a functionality in your payroll software that allows you to calculate and record holiday entitlements could also be useful. Furthermore, some software let you store employee records and information, such as previous employment history, education, references etc.

Another useful feature of a payroll system for companies that do not use standard pay intervals (weekly/ monthly) is the ability to adapt to different intervals (fortnightly/ quarterly) or automate shift differential calculations.

When your business is small, you might only require a single user operation, but as your business grows, a multiple user option could be useful. And as your business grows and your needs change, a payroll software that you can customize and alter is a useful tool.

Lastly, some payroll software lets you generate particular reports that others do not, such as payroll history, deduction analysis, expenses and benefits reports as well as the ability to print pay slips.

Integrating payroll with other HR tools

Integrating your payroll system with other HR tools offers several advantages that can streamline operations and enhance efficiency.

Firstly, it ensures data consistency across your HR platforms, reducing errors caused by manual data entry. This integration also facilitates better analytics by consolidating data, allowing for more comprehensive reporting and insights into workforce costs and trends.

Moreover, it improves the employee experience by providing a centralized portal for accessing personal payroll, benefits, and HR information, which can increase transparency and satisfaction.

Lastly, it saves time and resources, allowing HR staff to focus on more strategic tasks rather than administrative ones.

-360x360.jpg)

(1)-640x380.jpg)