-640x380.jpg)

How do you manage expenses at your workplace? Expense management refers to organized methods and policies regarding employee expenses, including structured processing of expense reports, expense approvals, employee reimbursement expenses, and more. If employee expenses are not monitored and managed correctly, your costs can increase which will cause your revenue to decrease. It is imperative that all HR managers prioritize having effective expense management in place as it can increase profitability.

Related articles:

Time and Attendance Management: Everything You Need to Know

Employee Training: The Ultimate How-to-Guide

Difference Between Expense and Quality

First, it is important to acknowledge the difference between expense and quality, as not all expenses are bad for business. When scanning expense reports, the employees with the largest expense transactions might not necessarily be the ones that need to cut their expenditures. This is because of the difference between expense and quality.

A quality expense is considered an expense that has a certain return on investment expected. If your employee is having high-quality expenses, they might be well justified as they are giving a return on investment. Cutting these expenses might hurt your business’ investments as they are directly linked to measurable benefits. Therefore, all HR teams should analyze employee expenses to find which ones are considered quality expenses and which ones could be cut.

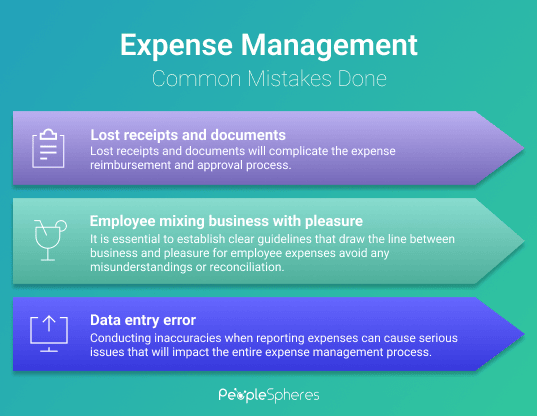

Common Mistakes Done with Expense Management

In order to help you avoid making mistakes when performing expense management, we provide you with a list of common errors done:

Lost receipts and documents

If your expense report system is not entirely automated, you might be facing challenges such as lost receipts and documents. If many receipts pile up on a desk, they can easily be lost. Employees might also lose a receipt on their way back from their trip. Lost receipts and documents will complicate the expense reimbursement and approval process, and in the worst-case scenario, such as if there has been a cash outlay, employees might end up not getting reimbursed for business expenses and be forced to pay out of pocket.

To ensure that no valuable documents get lost in any process, your HR management team needs to have a sustainable system in place for receipts and invoices. Employees can also be encouraged to take a picture of each receipt, in case they would get lost. Implementing a digital documentation process using standardized quote invoice estimate templates can further enhance organization, accessibility, and security of financial records, reducing the risk of loss or misplacement and ensuring seamless expense tracking and reimbursement. Using an online free invoice generator can further simplify invoice management, making it easier to create, store, and retrieve invoices when needed.

Employee mixing business with pleasure

It is essential that your human resources department establish clear guidelines on approved employee expenses with the corporate card. If not, there is a risk that employees mix business with pleasure expenses, this is especially true for travel expenses when pleasure and business can be very closely related.

Different companies might also draw the line between pleasure expenses and business expenses at separate places, therefore, it is essential that you communicate with your employees on which expenses you will approve and not, especially for a new hire. This should be formally communicated in a document of guidelines or policy to avoid any misunderstandings or reconciliation.

If your employees are not completely understood the difference between pleasure and business, it will ultimately lead to that your company is paying for your employee’s personal delights, which is something that everyone wants to avoid.

Data entry error

When an expense manager is performing a manual data entry for an expense report, it leaves room for human error. Error in an expense entry can be anything from duplicating data to mistakenly adding a zero. Spreadsheets provide valuable insights, but when it comes to data entry it leaves a significant amount of room for error. Conducting inaccuracies when reporting expenses can cause serious issues that will impact the entire expense management process, which is why all HR professionals need to ensure that this is avoided through a streamlined utility bill management system. This can effectively reduce the likelihood of errors in expense reporting.

Reduce Healthcare Cost

As healthcare keeps increasing, it is worth mentioning in the case of expense management. Depending on the contracts, high employee medical costs can have a direct impact on a company’s HR budget. Therefore, it is important to reduce healthcare costs as much as possible.

Lowering healthcare costs can give you a competitive advantage in recruiting as some employees might be convinced to work for an organization that offers lower healthcare costs than others. Employees are normally happy to hear suggestions to cut their medical bills. For example, you can propose for staff to visit their physician during business hours since this usually costs less. You can also provide telehealth services, as this is normally cheaper than the emergency room or doctor visits.

Look over the contracts regarding healthcare at your company and identify ways to lower healthcare costs as a part of your expense management.

How is Expense Management Changing

To avoid mistakes, the field is constantly changing and improving. Today, HR professionals are assisted with HR technology to keep their employee expenses in check as expense reporting is switching from a heavily paper-based process to a completely paperless, automated process in a cloud-based management solution. The expense management solutions offered on the market today, track and automates processes such as approvals, reimbursements, invoices, and more.

Policies to be Implemented for Expense Management

All companies should have expense policies that define what employees are allowed to do with the company’s money, especially during business travel. This is most commonly expressed in a document stating company policy which all employees need to sign. An expense policy avoids any misunderstanding regarding which expenses are to be categorized as personal and which are to be considered corporate.

When creating an expense policy, start with including a complete list of which expenses the company approves of. This can be anything from specified travel expenditures such as hotel accommodations, to business-related items such as subscriptions and equipment. It can also be a good idea to include expenses that the company will always reject as a guideline.

In general, the policy should be written in clear language and include detailed budgets and explanations to make it as obvious as possible and leave out any room for misinterpretation.

After stating what is to be claimed and not, consider including a guide on how to claim expenses and what would happen in the event of a dispute. Remember, the policies are meant to clarify for employees what should go on the corporate credit and what should go on the personal credit, along with guiding them through the expense reporting process. If you communicate your policies correctly, you can expect employee satisfaction to increase.

Utilization of Software for Expense Management

The utilization of software for expense management is necessary to avoid mistakes and inadequacies. A cloud-based travel and expense management system saves your team time and effort while it improves accuracy and consistency in your expense tracking and logging.

According to ISG in 2021, organizations also achieve cost savings across IT and HR by moving to HR SaaS solutions while capturing business value. By using cloud-based HR solutions for your employee expenses, you are likely to improve both your financials and employee experience as you eliminate the risk of misunderstandings or inefficiencies during the process.

What is Software Automation

Software automation manages your employee expenses for you. An automated system as a management tool automates processes in workflows which reduces time-consuming and repetitive tasks that otherwise need to be performed by you or your team.

For example, expense management software automation can route expense claims based on criteria such as expense type, project, or value, rather than this being done manually by an employer. Software automation will save your team both time and money and should be implemented in your expense management.

Types of Software

There are many HR solutions offered on the market. You can choose between a specified expense management solution or an all-in-one HRIS system. There are benefits and drawbacks to each type of software and knowing which one to choose for your organization can be difficult.

When looking for software that seamlessly monitors and manages your employee expenses, consider management systems that include tracking software, effective reporting capabilities in a reporting software, receipts scanning, credit card integrations, automated compliance features, and streamlined approvals. If you are a smaller company with fewer resources, prioritize a system that provides an expense report template.

How to Choose a Software that fits your Organization

In most cases, it is best to choose a specialized system for the HR management process that you want to modernize as it will most likely be the best solution.

However, this can lead you to have numerous amount of management solutions, ultimately leading your employees to waste time navigating between systems and multiple data entries. In this case, it is suggested to use a unified solution that consolidates all your HR apps on an employee dashboard, offering single-point access for employees.

PeopleSpheres connects and integrates all your duplicated and dispersed HR systems on a single platform, providing you with a customizable solution it allows you to integrate any best-in-class system you would like. By simply removing the hassle of multiple data re-entry, PeopleSpheres reduce your HR workload by 30 percent.

Benefits of Software

There are numerous benefits to automating business processes, including managing expense reports included. All more companies are choosing to enforce cloud-based solutions as human resource departments are looking for systems that strengthen and support employee experience and agile business models.

Having an automated expense system to track expenses allows businesses to cut costs across both IT and HR, while capturing measurable business value. Many solutions are available as mobile apps, allowing a quick response from upper management and employees to create an expense on their mobile device from anywhere, promoting a virtual workforce.

Using a management system that ensures mobile access through a mobile app is also valuable for travel management as it becomes easier for employees to log a travel expense report when they are on a business trip.

Conclusion

Expense management is an important part of HR management. Keeping employees’ expenses in check is essential to not have unnecessary expenditures that will decrease profitability. All HR teams should establish clear and concise policies that should aim to guide employees on their spending management and how to report expenses.

An easy-to-use expense management solution streamlines the process of managing expenses. By using a software-as-a-service (SaaS), the employee experience can be improved, and human resource teams can be assisted in managing and tracking expenses.

There are numerous software available on the market to streamline and automate your expense reporting, however, it is recommended to use a unified solution, PeopleSpheres, that consolidates all your solutions onto one platform, reducing HR workload.

We hope that this article has taught you how to effectively track your employee expenditure. If you want to learn more about HR management, make sure to check out the rest of our blog!

-360x360.jpg)

-640x380.jpg)

-640x380.jpg)