A wage levy is a collection tool the IRS uses to recover unpaid federal taxes. Unlike creditors, the IRS does not need to obtain a court order to levy wages. They must, however, follow some guidelines before issuing the wage levy — such as sending the taxpayer a Final Notice of Intent to Levy if the taxpayer refuses to pay, or to make arrangements to pay the tax bill.

Also, the IRS will send the taxpayer’s employer a levy notice via Form 668-W(C)(DO) or Form 668-W(ICS), Notice of Levy on Wages, Salary and Other Income. The IRS wage levy form includes a Statement of Exemptions and Filing Status, which should be given to the employee.

Employers are required to start withholding from the employee’s wages shortly after receiving the IRS wage levy, so it’s important to act quickly.

Related articles:

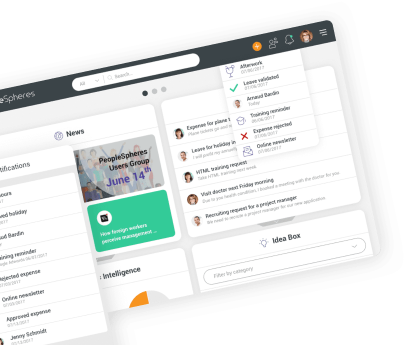

Payroll Management: Processes and Solutions

5-Step Plan for Getting a Handle on Pay Equity Issues

Verify the IRS wage levy information

…by checking the name, address, Social Security number and other employee-related details. If the employee has left the company, notify the IRS accordingly.

Give the employee the Statement of Exemptions and Filing Status

…plus a copy of the IIRS wage levy notice. The employee needs to complete the Statement of Exemptions and Filing Status and return it to you within three days.

The statement of exemptions, not the employee’s Form W-4, should be used to determine the employee’s filing status and number of exemptions when calculating the wage levy amount. If the employee fails to give you the statement of exemptions within three days, use “Married Filing Separately” with one exemption.

Inform your payroll service provider or applicable third-party vendor of the IRS wage levy

…if you outsource wage garnishment administration. Be sure to give the provider all the information necessary to properly withhold and administer the levy on your behalf.

Consult IRS Publication 1494

…to determine how much of the employee’s net pay should be exempt from the levy for each pay period; this amount is based on the employee’s statement of exemptions.

A wage levy is subtracted from wages after withholding payroll taxes plus child support and voluntary deductions that were already in place when you received the levy. However, per the IRS, “voluntary deductions can be disallowed, if they are so large they defeat the levy.” While you typically should not offer the employee any new voluntary deductions after receiving the wage levy, the IRS allows exceptions on a case-by-case basis.

Keep withholding the IRS wage levy

…until the full amount has been paid or the IRS tells you to stop withholding payments.

Avoid violating U.S. Code Section 1674

…which forbids employers from firing an employee because of a single wage garnishment. The U.S. Department of Labor, not the IRS, determines whether the employer has breached Section 1674, which is punishable by a fine of up to $1,000 or imprisonment of up to one year, or both.

With these helpful tips, you no longer need to worry about what to do if you receive an IRS wage levy. Make sure you are thorough when checking all personal information and do not hesitate to flag up any discrepancies you spot in the IRS wage levy.

-360x360.jpg)